Navigating the complex world of federal tax credits can be daunting for any business, particularly within the healthcare industry. The Employee Retention Credit (ERC), a refundable tax credit designed to encourage businesses to retain employees during economic hardship, presents a valuable opportunity for California healthcare staffing agencies. Understanding the eligibility requirements and claiming this credit effectively is crucial for maximizing financial benefits. This comprehensive guide delves into the intricacies of the ERC for California healthcare staffing agencies, outlining key provisions, determinants, and steps to ensure a successful application process.

To qualify for the ERC, California healthcare staffing agencies must meet specific criteria related to their operational status during eligible periods. These periods are typically defined by significant slowdowns in the healthcare industry due to factors like public health emergencies or economic downturns. Agencies must demonstrate significant revenue loss or decreased operations compared to previous periods.

- Additionally, agencies must provide documentation substantiating their eligibility, including financial records, payroll information, and operational data. Thoroughly documenting these aspects is essential for a successful application.

- Furthermore, understanding the nuances of claiming the ERC is paramount. Agencies should reach out to qualified tax professionals specializing in ERC regulations to ensure accurate and timely submissions.

By leveraging the California Healthcare Staffing ERC Tax Credit, agencies can potentially mitigate financial burdens and channel resources towards bolstering their workforce and operations. Thorough planning and expert guidance are key to unlocking this valuable benefit and navigating the complexities of the ERC program.

Unlocking Texas Hospital ERC Refunds in 2024: Your Application Roadmap

Are you a Gulf Coast hospital eagerly pursuing potential Employee Retention Credits (ERC) refunds for 2024? The path to unlocking these vital resources can seem challenging, but with a clear roadmap, you can navigate the process and maximize your eligibility. This thorough guide will detail the essential steps to accurately apply for Texas Hospital ERC refunds in 2024.

- First, identify your hospital's qualifying criteria based on recent income trends and operational challenges faced during the pandemic.

- Compile all necessary records to support your application, including payroll figures and economic statements.

- Consult with an experienced ERC specialist who understands in-depth knowledge of Texas requirements and proven application strategies.

Filing your ERC application promptly to the relevant authorities is crucial to claiming your refund. This guide will also shed light on the timeline for ERC refund consideration, empowering you to anticipate for a smooth and timely experience.

Navigating New York Medical Practice SETC Qualification Criteria

Pursuing a medical practice license in New York State involves a rigorous evaluation process that includes meeting specific requirements for the Scheduled Equipment and Treatment Centers (SETC) designation. Eager practitioners must carefully Analyze the SETC qualification criteria outlined by the Department of Health, ensuring compliance with all applicable Guidelines. This Includes a comprehensive understanding of equipment specifications, treatment protocols, and facility Necessities to Confirm the provision of safe and effective medical care.

- Key factors considered include the type and quantity of medical Tools employed, adherence to established treatment protocols, and the Presence of qualified personnel.

- Satisfactory completion of a thorough application process, which may involve site inspections and documentation review, is Essential for obtaining the SETC Designation.

Navigating these qualifications effectively requires a proactive approach. Healthcare professionals are Recommended to Seek with regulatory bodies and industry experts to Gather comprehensive guidance on the SETC System.

Receive Florida Clinic COVID Tax Credits: No Upfront Fees, Maximum Savings

Navigating the complexities of tax credits can be difficult, but securing financial relief for your clinic needs doesn't have to be. With Florida's comprehensive COVID Tax Credit program, you can leverage substantial savings without any upfront fees.

This innovative initiative offers clinics a pathway to reduce their tax liability while encouraging the crucial healthcare sector. By leveraging this program, you can effectively lower your operational burden and reinforce your financial stability.

- Explore the eligibility requirements for Florida Clinic COVID Tax Credits today.

- Consult our experienced team to determine your eligible savings.

Don't miss out on this exceptional opportunity to save taxes and devote resources back into your practice. Contact us now to start the process and unlock the full potential of Florida's COVID Tax Credit program.

State of Illinois Nursing Home ERC Refund Cut Off

Time is running out for eligible check here Illinois nursing home residents and their families to claim their refund. The deadline for the Employee Retention Credit is coming up quickly. Don't miss out on this valuable chance to obtain a payment for 2023 .

Speak with an experienced tax professional today to determine your qualifications and optimize your refund potential.

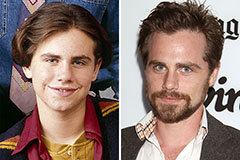

Rider Strong Then & Now!

Rider Strong Then & Now! Molly Ringwald Then & Now!

Molly Ringwald Then & Now! Pauley Perrette Then & Now!

Pauley Perrette Then & Now! Tonya Harding Then & Now!

Tonya Harding Then & Now! The Olsen Twins Then & Now!

The Olsen Twins Then & Now!